50+ S Corp Late Filing Penalty Abatement Letter Sample

Please waive the proposed penalty under Revenue Procedure 84-35 as the above requirements have been met. The penalty for paying late is 5 of the tax owed for each month the tax is unpaid with a maximum of 25 of the tax owed.

401k Mistakes Irs Updated 401k Fix It Guide

If youve got a 4000 penalty--or a 40000 penalty--you want to make sure you use every possible argument available to you to help the IRS see that you qualify for abatement.

50+ s corp late filing penalty abatement letter sample. CHOOSE 1 OF THE FOLLOWING THAT BEST APPLIES TO YOUR SITUATION. Use the letter to compose a written request for penalty abatement based on the first-time penalty abatement criteria. Make them reusable by generating templates add and fill out fillable fields.

The template is available free to AICPA members. The company writes a penalty abatement letter. All partners timely filed their form 1040 for 2008 and fully reported their shares of income deductions and credits on their timely filed returns.

Please advise of the abatement. This process gets missed by a lot of tax relief firms and tax attorneys. Updated 123 days ago Get Free Money Back.

For taxpayers willing to write a penalty abatement letter to the IRS you should know that there are a few necessary things that need to be included in the letter to be sent. This increases to 210 per month in tax year 2020. In response to the unique aspects of the pandemic the AICPA has created a custom penalty abatement letter for members to use as a starting point for relief.

This letter is formatted in an optimal way for the IRS to process the request. Internal Revenue Service use the address provided in your tax bill Re. Just Ask For a First Time Penalty Abatement.

It may be to your advantage to wait until you fully pay the tax due prior to requesting penalty relief under the Services first time penalty abatement policy. Practitioner requests that the penalty abatement provision in Revenue Procedure 84-35 that waives penalties for late filing for small partnerships fewer than 10 partners also apply to S corporations with 10 or fewer members. The failure-to-pay penalty will continue to accrue until the tax is paid in full.

The penalty is in fact a failure to file penalty and its 210 per month per partner or 200 per S corp shareholder up to 12 months total. Then penalty is 195 per stockholder per month for each month that the return was late. They even have a certified mail receipt to prove it.

The penalty can be assessed for a maximum of 12 months. The taxpayer files a penalty non-assertion request along with their official return asking the Internal Revenue Service not to levy a penalty. You have paid or arranged to pay any tax due.

A letter like the one above will require about two pages. Here we go through the IRS First Time Penalty Abatement process. S Corp Failure-to-File Penalty.

The 2011 penalty is 4680 and the 2012 penalty is 3510. The penalty for failure to file a federal S corporation tax return on Form 1120S or failure to provide complete information on the return is 195 per shareholder per month. Two partners 12 months late filingpenalty.

For some reason they had their preparer file their Corporate returns for 2011 and 2012 about a year past the deadline for each return. The second method is later in the process when the IRS has already levied the penalty. First Time Penalty Abatement from IRS With Sample Letter 1 27 Dec 2016 in Tax Guide tagged forms IRS tax debt tax resolution by Robert Kayvon Esq.

S-corp late filing penalty abatement letter sample. Approve forms with a legal digital signature and share them via email fax or print them out. You filed all currently required returns or filed an extension of time to file.

They filed their Form 1120 S by the March 15 deadline or filed a Form 7004 Automatic Extension Request. Download documents on your laptop or mobile device. Your Name Your Address Your Social Security Number MMM DD YYYY Dear SirMadam.

The primary reason that. IRS Penalty Abatement Sample Letter Template. Assessed at 200 per shareholder per month.

But now they have an IRS letter with a substantial late filing S Corp penalty. The first way is to apply before the penalty is ever assessed. The template is available free to AICPA members.

IRS Reasonable Cause Letter Sample. How to Beat IRS Penalties. I am writing to respectfully request the abatement of penalties totaling ENTER DOLLAR AMOUNT that was assessed related to the attached notice dated ENTER DATE OF NOTICE.

IMRS 10-0001240 Late Filing Fees for Small Partnerships. It contains IRM citations to substantiate the relief and can help practitioners bill for their work. For S corporations and partnerships the penalty for filing late is 200 per partner or shareholder per month with a maximum of 2400 12 months.

2013 has not been filed. Here is a simplified IRS letter template that you can use when writing to the IRS. Ive written letters that required between 9 and 14 pages.

To request that a tax penalty be waived the taxpayer would be required to write a penalty abatement letter to the IRS to make this request. Fill out forms electronically utilizing PDF or Word format. Thats the story faced by thousands of Realtors and other small businesses who operate as S Corporations this year.

Request for Penalty Abatement under Reasonable Cause. The AICPA has a template for practitioners to use to request a reasonable-cause penalty abatement on behalf of their clients.

Http Documents1 Worldbank Org Curated En 295321600473897712 Pdf Social Protection And Jobs Responses To Covid 19 A Real Time Review Of Country Measures September 18 2020 Pdf

Pdf Brochure Of All Our Books Long Version Ilw Com

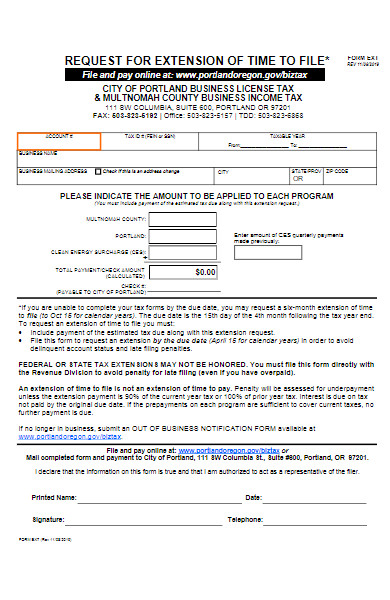

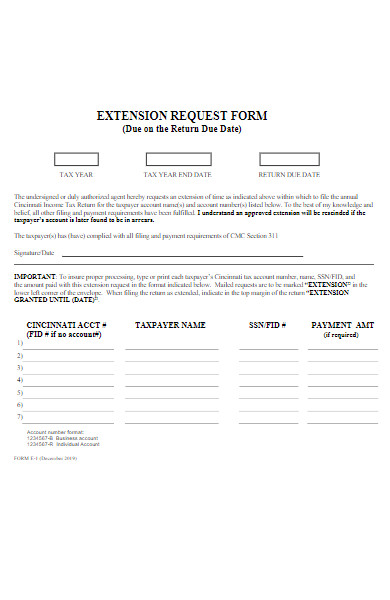

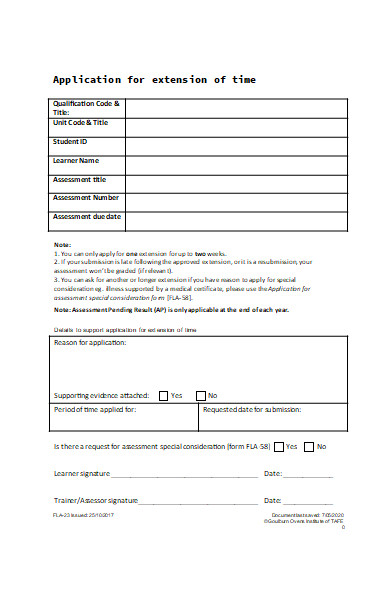

Free 50 Extension Forms In Pdf Ms Word

1040 540 Tuneup Update Pdf Free Download

Pdf Tax Morale And Its Effect On Taxpayers Compliance To Tax Policies Of The Nigerian Government

Hafidh Salman Al Samarrai Doctorial Thesis Road Traffic Noise And Its Prediction By Computer Simulation W Particular Reference To Signalized Intersections Pdf Computer Simulation Car

Http Digilib Ars Ac Id Index Php P Fstream Pdf Fid 1830 Bid 5375

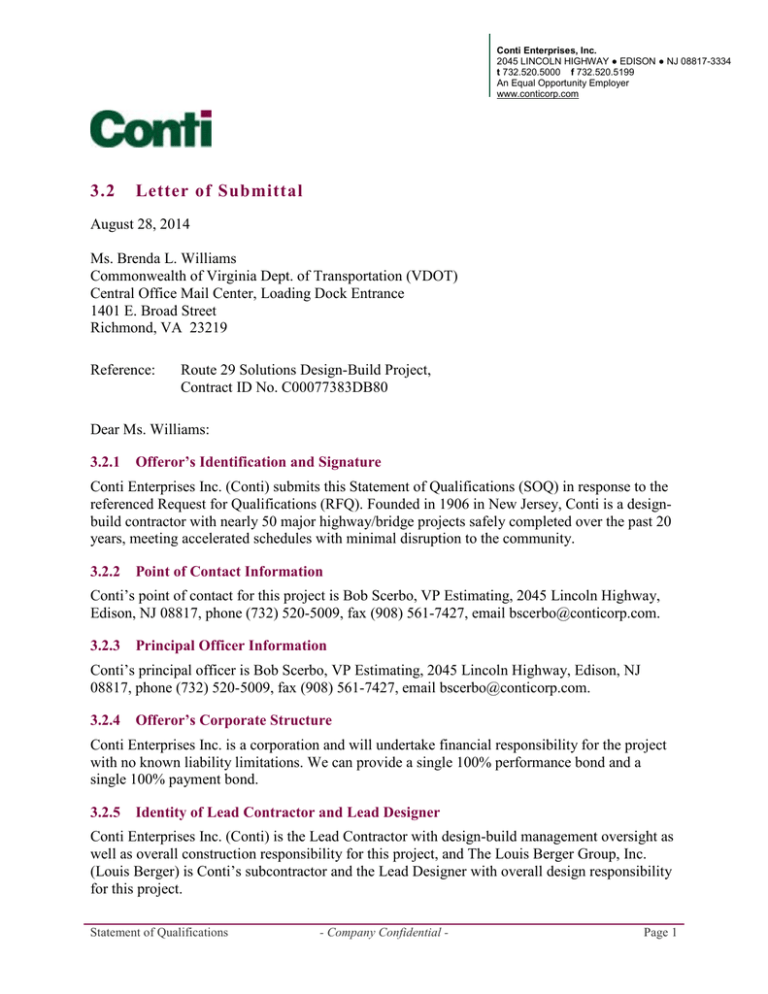

3 2 Letter Of Submittal Virginia Department Of Transportation

Https Www Adb Org Sites Default Files Linked Documents 55077 001 Sd 04 Pdf

Https Documents1 Worldbank Org Curated En 467521607723220511 Pdf Social Protection And Jobs Responses To Covid 19 A Real Time Review Of Country Measures December 11 2020 Pdf

Target Score Second Edition By Cambridge University Press Issuu

50 Sample Law School Personal Statements Harvard Law School By Albert Issuu

Http Documents1 Worldbank Org Curated En 454671594649637530 Pdf Social Protection And Jobs Responses To Covid 19 A Real Time Review Of Country Measures Pdf

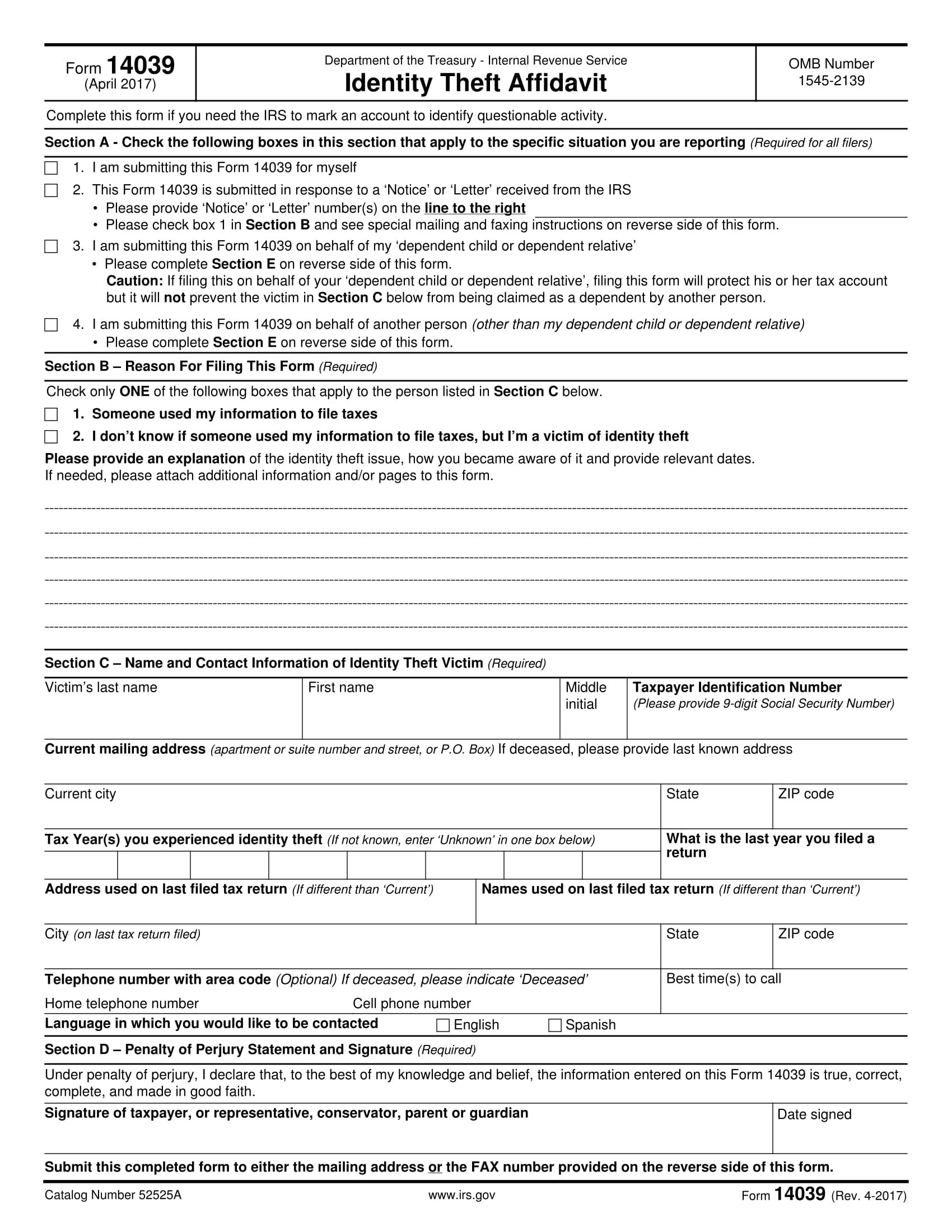

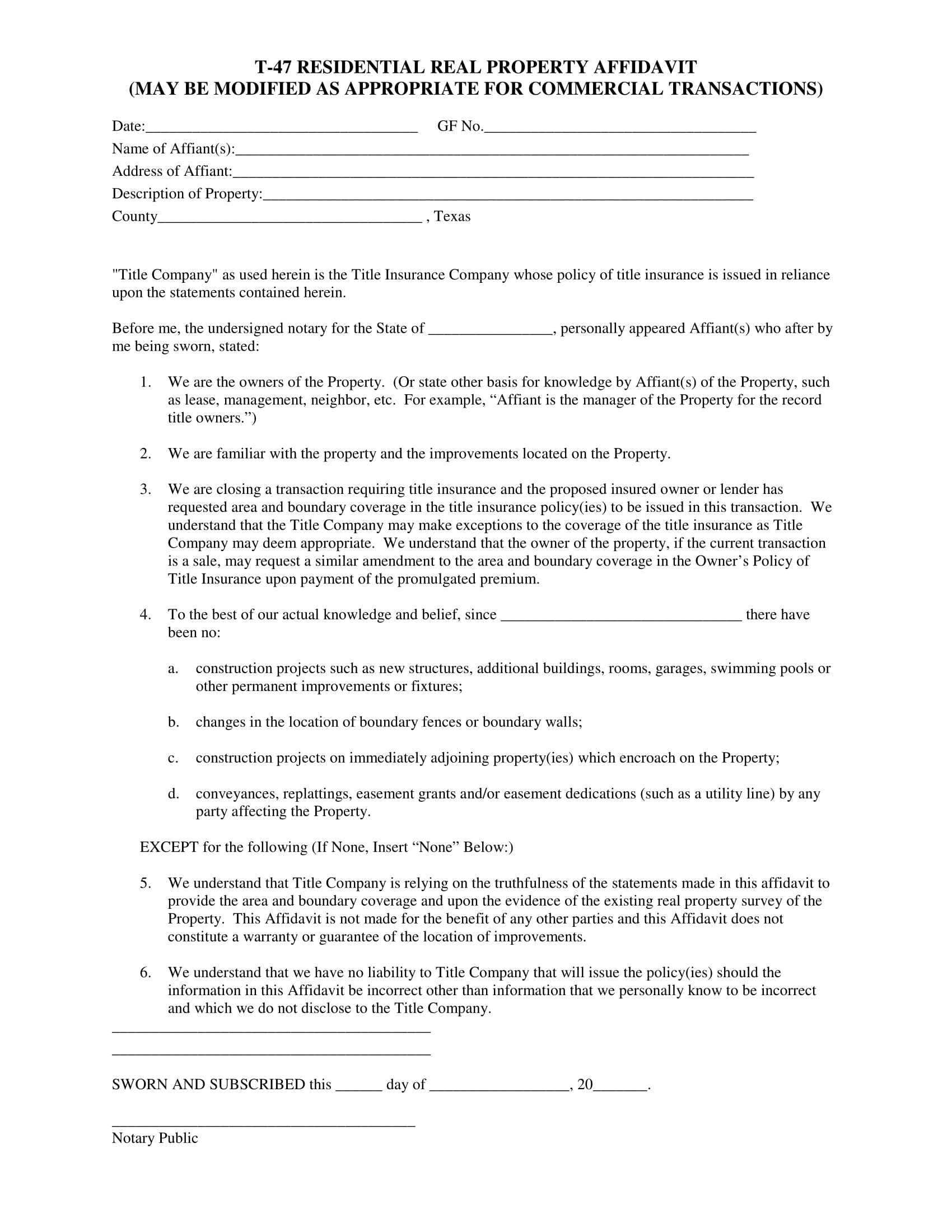

Free 22 Sample Affidavit Forms In Pdf Ms Word Excel

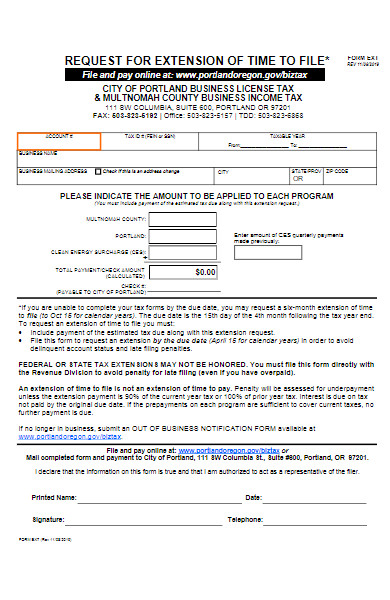

Free 50 Extension Forms In Pdf Ms Word

Free 50 Extension Forms In Pdf Ms Word

Download Townnews Com

Free 22 Sample Affidavit Forms In Pdf Ms Word Excel

Ferdinand Lundberg The Rich And The Super Rich A Study In The Power Of Money Today 1968 Wealth Stocks

Strategic Marketing 8th Edition Text Book Strategic Management Marketing Strategy