Premium Bonds Means Tested Benefits

The good news is that between 6000 and 16000 benefits are only reduced by 1 for every 250 over the 6k until you reach 16k when all means tested benefits would stop. Secondly you get a fixed interest rate on these gold bonds.

Why Red Aspen Lashes Independent Red Aspen Brand Ambassador False Lashes Aspen Lashes

It may be that youll have to pay towards the cost of your care.

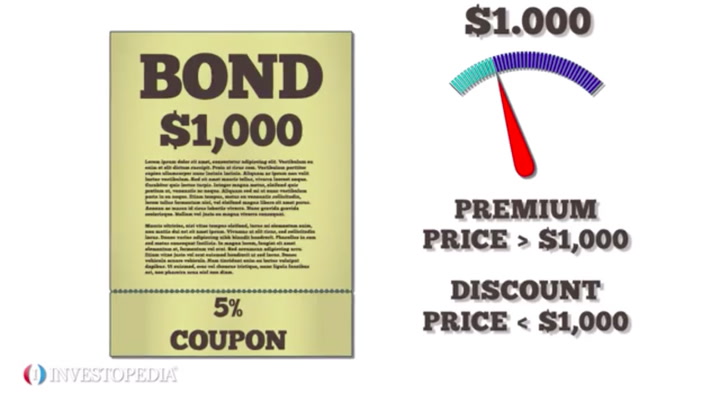

Premium bonds means tested benefits. Please reference page 2 step 1 sub-step 1b of the Form I-912 instructions PDF for examples of what is considered a means-tested benefit. When bond interest rates increase prices go down. Means-tested benefits have the advantage of being more narrowly targeted and therefore less costly than universal benefits.

Thirdly gold bonds have no holding or storage cost. Each benefit has different eligibility criteria which your income. A premium bond is a bond trading above its par value.

Still premium bonds with higher pricing and a lower rate might earn more if the market rate is lower than the bond rate. Social Fund Sure Start Maternity Grant Funeral Payment Cold Weather Payment. The means-tested benefits are.

Tax Credits Child Tax Credit and Working Tax Credit Housing Benefit. Premium bonds used to be unique in their tax-free status but since the introduction of the PSA in 2016 the vast majority of savers do not see any tax liability on their returns. Or there may be people who dont realize theyre eligible for the benefits or dont know how to apply and so miss out.

The basics Investing in Premium Bonds is very straightforward. A bond that is trading above its par value original price in the secondary market is a premium bond. Every Premium Bond is entered into every draw and every Premium Bond has an equal chance of winning a prize.

With means-tested benefits theres also the chance that people will incorrectly or fraudulently represent their means. And with NSI Premium Bonds your money is 100 safe as were backed by HM Treasury. This level is an estimate of the amount you need to live on and is set by the government.

All investments are now tax-free. A Premium Bond is a lottery bond issued by the United Kingdom government since 1956. Generally the council helps to pay for care costs if you have savings less than 23250.

If one of your Premium Bonds wins a prize that has no effect on the ability of any of your other Premium Bonds to win a prize that month. Claimants need to show a means of income and capital below a certain level to get means tested benefits 2021. The more money you have the more youll be expected to pay.

To illustrate the premium on bonds payable lets assume that a corporation prepares to issue bonds. Which benefits are means-tested. Over 500 new Medicare Advantage and Part D prescription drug plans and two new pharmaceutical manufacturers of insulin are joining the model this year to provide even more opportunities for eligible seniors to reduce their out-of.

What Is a Premium Bond. Premium Bonds were designed as a tax-free product and the maximum holding limit gives individuals the opportunity to have a potential tax-free return by way of the prize draw. A bond trades at a premium when it offers a coupon rate higher than prevailing interest rates.

CMS will continue to test the Part D Senior Savings Model in more than 2100 plans in 2022 increasing access and affordability to select insulins for seniors. The principle behind Premium Bonds is that rather than the stake being gambled as in a usual lottery it is the interest on the bonds that is distributed by a lottery. Income-related Employment and Support Allowance.

For each 1 invested youll get a unique bond number - so if you save 500. A financial assessment or means test works out if the council will pay towards your care. The lowest prize is currently 25.

One disadvantage however is that a means-tested benefit imposes an implicit marginal tax on people with earnings close to the income level at which the benefit phases out. A sovereign gold bond is a better investment than physical gold because of many reasons. These are investments packaged as life assurance primarily designed for investment but with an insurance over-ride often 101 of the investment value.

The following benefits are means-tested. At present it is issued by the governments National Savings and Investments agency. Firstly these gold bonds allow you to get a lower price than physical gold when applied online.

It looks at how much money you have. They are a very old type of investment policy and thus are governed by some complex rules. A bond will trade at a premium when it offers a coupon interest rate that is higher than the current prevailing interest rates being offered for new bonds.

The Premium Savings Bond Regulations do not allow for Premium Bonds to be invested in trust as the investment was created for individuals to invest in. The funds are taxed and because this is taken into account when you. Income-based Jobseekers Allowance JSA Income-related Employment and Support Allowance ESA Income Support.

Single premium investment bonds. A current list of means-tested benefits would include. Theyre offered by National Savings Investment NSI which instead of interest offer the chance to win tax-free cash prizes.

The highest prize in Premium Bonds is 1000000. This is a discounted bond meaning an investor would pay less for the same yield making it a better option. This is caused by the bonds having a stated interest rate that is higher than the market interest rate for similar bonds.

Premium on bonds payable or bond premium occurs when bonds payable are issued for an amount greater than their face or maturity amount. The bonds are entered in a monthly prize draw and the government promises. What is premium on bonds payable.

Gold bond advantages over physical gold. Documenting Means-Tested Benefits. This is the attraction to premium bond pricing and rates.

Your income and capital must be below a certain limit for you to be eligible to claim any means-tested benefit. This is because investors want a. Premium Bonds are one of the most popular savings options in the UK and in 2015 there were over 21 million people holding over 51bn in bonds.

Every 1 you invest buys a unique Bond number with a separate and equal chance of winning in a monthly prize draw. A means-tested benefit is one for which your incomeresources determine eligibility andor the benefit amount. That means that you are able to use other investment options that potentially offer better returns.

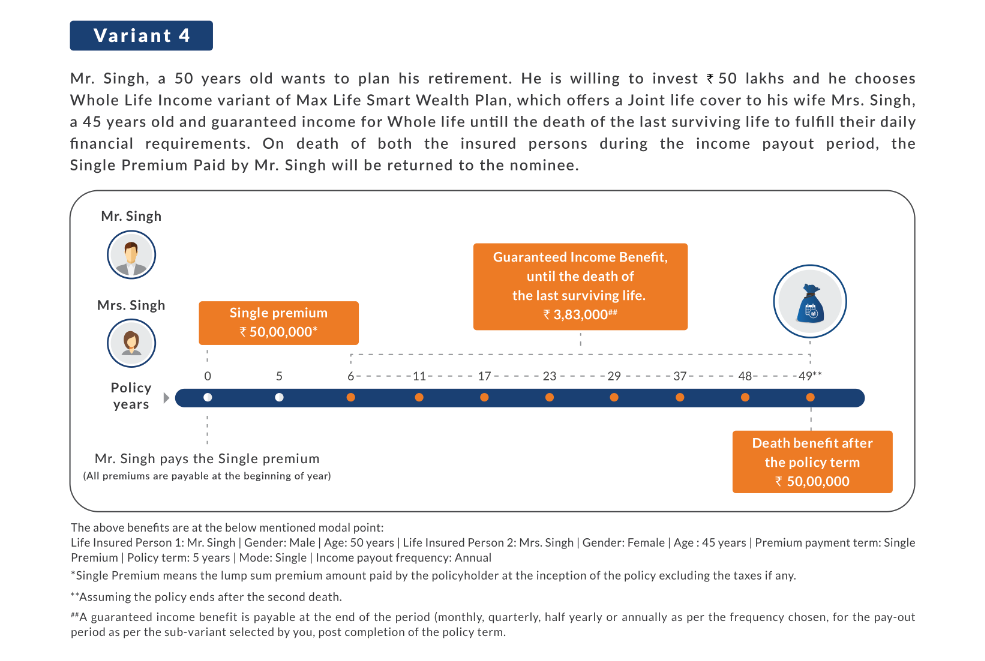

Max Life Smart Wealth Plan Max Life Insurance

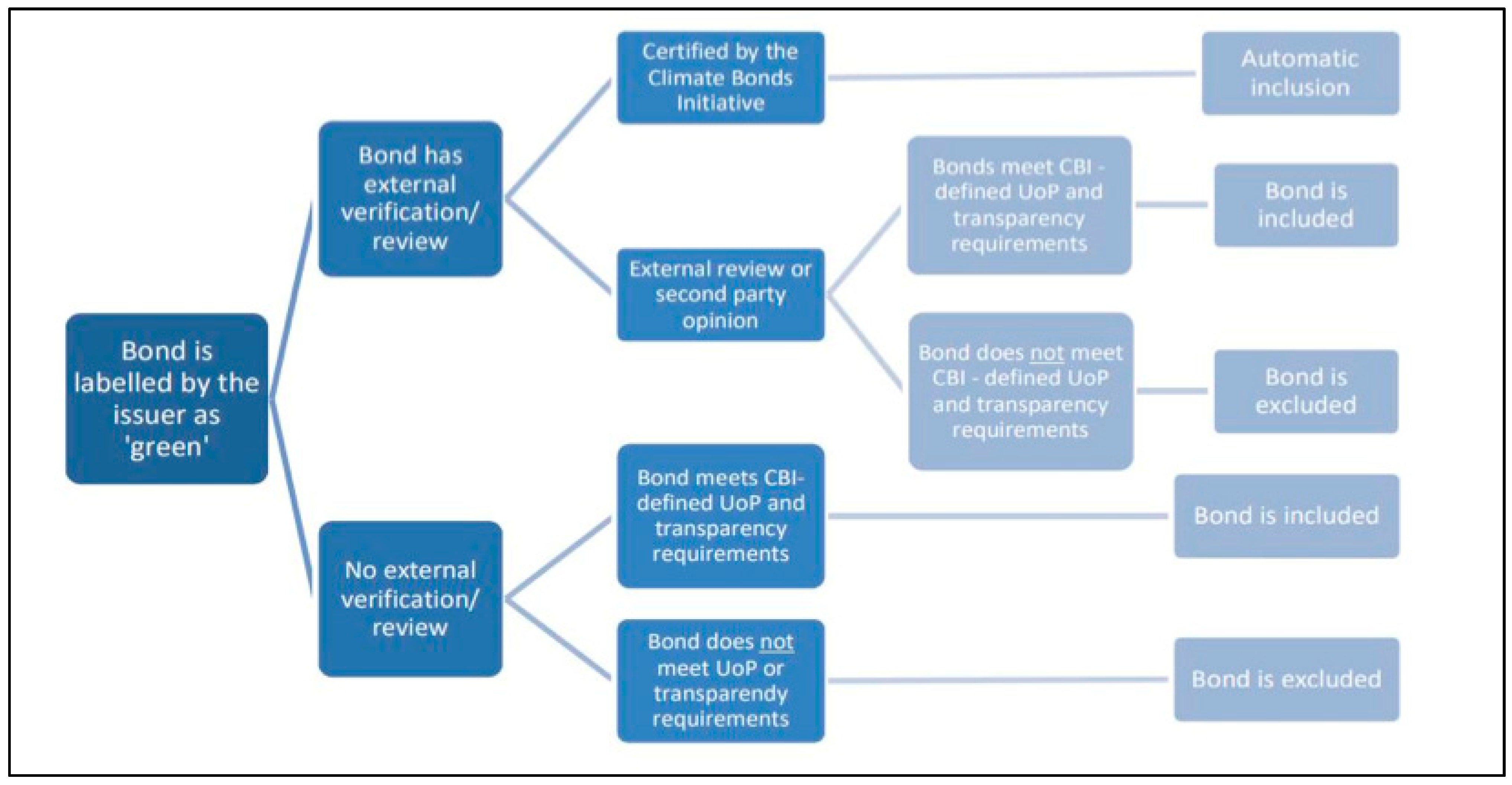

Sustainability Free Full Text The Green Bonds Premium Puzzle The Role Of Issuer Characteristics And Third Party Verification Html

Max Life Smart Wealth Plan Max Life Insurance

How To Prepare Consolidated Balance Sheet Of Holding Company Accounting Education Business Analysis Small Business Finance

Internal Energy Physics About Internal Energy Physics Science Biology

Forex Infography Intraday Trading Swing Trading Stock Trading Strategies

Better To Invest In Term Plans Than Return Of Premium Ones Businesstoday

Dime Method For Insurance Stock Advisor First Love Insurance

/dotdash-INV-final-The-Equity-Risk-Premium-More-Risk-For-Higher-Returns-Apr-2021-01-af6d3ee16ba14e2889ab624bf6e6d185.jpg)

The Equity Risk Premium More Risk For Higher Returns

We Surveyed A Bunch Of Organic Chem Professors And This Is What They Told Us Go To Www Aceorganicchem Com Organic Chemistry Elite Preview School Chemi

:max_bytes(150000):strip_icc()/dotdash-INV-final-The-Equity-Risk-Premium-More-Risk-For-Higher-Returns-Apr-2021-01-af6d3ee16ba14e2889ab624bf6e6d185.jpg)

The Equity Risk Premium More Risk For Higher Returns

What Is Volatility 75 Index Index Stock Index Volatility Index

Molarity Easy Science Study Chemistry Chemistry Lessons Chemistry

Differences Between Ulip And Mutual Fund In 2021 Mutuals Funds Life Insurance Policy Investing

Lux Industries Limited In 2021 Lux Todi Limited Brands

Max Life Smart Wealth Plan Max Life Insurance

What Does It Mean When A Bond Is Selling At A Premium Is It A Good Investment